FRANKS, CASTEN: PETER ROSKAM RAISING TAXES ON MCHENRY COUNTY RESIDENTS

Video Highlights Backlash Over Peter Roskam’s Role as Author of Tax Scam Law

(Downers Grove, IL) October 14, 2018 – Today, the Casten Campaign released a video endorsement from McHenry County Chairman Jack Franks. McHenry County is one of the highest taxed counties in Illinois and the country, where Roskam’s own constituents are seeing tax increases due to the law he authored, in part because Roskam’s law took away their ability to fully write-off their state and local income taxes. Sixth District Congressional Candidate Sean Casten and McHenry County Chairman Jack Franks released the following statements:

“Jack Franks has spent his career fighting to lower taxes, and he knows firsthand just how harmful Peter Roskam’s tax bill is for his own constituents,” said Sean Casten. “By authoring Trump’s tax plan, Peter Roskam once again put the interests of the Administration over Sixth District families. In Congress, I will fight for legislation that benefits Illinoisans, rather than Peter Roskam’s record of raising taxes on his own constituents to fund tax breaks for corporate special interests.”

“By capping this deduction, we are taxing people twice,” Franks said. “Limiting the deduction will hurt our property value and give more incentive for homeowners to flee McHenry County. We’ve already lost population in the last seven years because our property taxes are too high. Peter Roskam’s decision to further burden his constituents is disappointing, especially knowing exactly how much it would hurt taxpayers.”

The script of the ad follows:

Hi, I’m Jack Franks, I’m the Chairman of McHenry County.

McHenry County is one of the highest taxed counties in the entire country.

Peter Roskam’s latest bill actually increased the property taxes, while also simultaneously devaluing their properties. It’s the worst double whammy any homeowner could ever have.

And I asked the Congressman not to support it, but he did – knowing it would hurt the folks here in McHenry County.

Sean Casten will reduce our property taxes and increase our property values.

That’s why I’m supporting Sean Casten in November, and I hope you all join me.

In November 2017, Chairman Jack Franks warned of the impact of Peter Roskam’s tax law, noting that “that more than 15,000 property tax bills exceed $10,000 in McHenry County. In other parts of America, having a $10,000 tax bill means having a mansion, but people with a $250,000 home in Woodstock pay that amount.” Last week, Peter Roskam declined to call on Governor Rauner to alleviate the burden of his tax law.

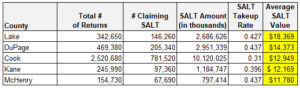

Recently-released IRS numbers covering the 2016 tax year show that residents of Lake, DuPage, Cook, Kane, and McHenry Counties had the highest average SALT deductions in Illinois – ranging from $18,369 in Lake County to $11,780 in McHenry.

1. IRS Statistics of Income County Data: https://www.irs.gov/