NEW IRS DATA SHOWS PETER ROSKAM TAX BILL “DEVASTATING” FOR SIXTH DISTRICT

Five Illinois Counties With Highest SALT Deductions Are All in 6th CD

(Downers Grove, IL) September 10, 2018 – Newly-released figures from the IRS show that taxpayers in the Sixth Congressional District will suffer the worst blow in Illinois from their own Congressman’s tax law, which capped the federal deduction for state and local taxes (SALT), including property taxes.

“These new figures show that Peter Roskam’s tax giveaway to corporations and the wealthiest one percent will have a devastating impact on local homeowners, increasing what they already pay in state and local property taxes by adding a federal tax on top,” Casten said. “It’s hard to imagine why our Congressman would pass a tax bill that punishes thousands of his own constituents – unless his real priority is enriching the corporate PACs that are giving millions of dollars to his campaign.”

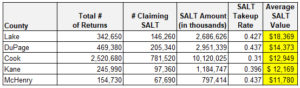

The new IRS numbers covering the 2016 tax year show that residents of Lake, DuPage, Cook, Kane and McHenry Counties had the highest average SALT deductions in Illinois – ranging from $18,369 in Lake County to $11,780 in McHenry.

In every case, the average SALT deduction exceeded the $10,000 annual cap in Roskam’s bill, meaning that 6th District residents will be “double-taxed” on the amount above the cap they pay in state and local taxes.

“Even worse, Roskam’s tax bill has added more than $2 trillion to our deficit, and he’s made it clear that he will close that gap by targeting Social Security and Medicare benefits,” Casten said. “In Roskam’s own words, ‘entitled individuals’ who are counting on those programs should beware.”

Following is a chart showing the number and percentage of taxpayers in each of the five counties in the 6th Congressional District who claimed the SALT deduction in 2016, and the average amount they deducted.

1. IRS Statistics of Income County Data:https://www.irs.gov/